FOR OUR PEOPLE.

FOR OUR CLIENTS.

FOR OUR FUTURE.

We’re not the kind of agency that just accepts change as a constant. We embrace it. And now we’ve evolved our identity to signal that loud and clear. It’s more than a new logo or tagline. It’s our declaration of who we are and what we value. Our commitment to move forward, always, for and with our people and clients. We are Ketchum. Progress at work.![]()

WORK + WINS

-

Gillette’s New Routine grooming tutorials gave quarantined viewers grooming guidance when barbershops closed during COVID-19.

-

Wendy’s launched their first breakfast menu with an audacious social stunt (involving a competitor’s former chef!) – resulting in increased sales and BILLIONS of media impressions

-

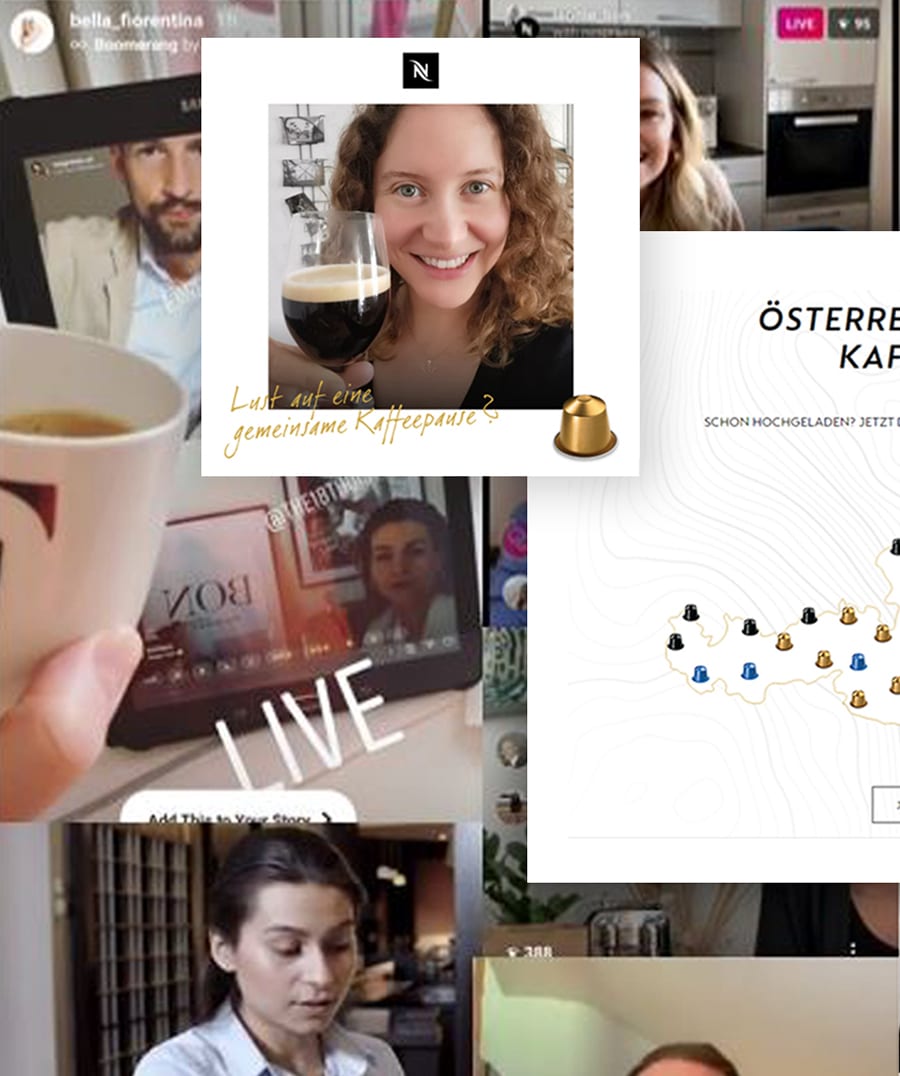

Drinking coffee together is a cherished experience in nearly every culture, but COVID-19 disrupted the social occasion at its very core.

NEWS + VIEWS

2024 Communications Trends

Major shifts in culture, tech, politics, and the economy set the stage for a year that will test the foresight, endurance, and creativity of communications professionals.

Ketchum Announces New U.S. Election Navigator Offering

New York (Nov. 9, 2023) - Leading global communications consultancy Ketchum announced today its new 2024 U.S. Election Navigator offering, designed…

Ketchum at Cannes 2023: Celebration and Inspiration

2023 turned out to be our most-awarded year in Ketchum’s history at the Cannes Lions International Festival of Creativity! Our…